Move in Fees vs Security Deposit

Move in Fees vs Security Deposit

Are you a landlord looking to secure reliable tenants for your rental property?

Understanding the difference between move-in fees and security deposits is crucial in ensuring a smooth tenancy.

We will explore the definitions and purposes of move-in fees and security deposits, compare the two, and discuss the factors landlords should consider when choosing between them.

Learn how SmartScreen can assist you in making informed tenant screening decisions.

What is Tenant Screening?

Tenant screening is the process of evaluating potential renters by conducting background checks, credit checks, and verification to assess their trustworthiness as tenants.

It plays a vital role in ensuring that landlords select reliable tenants who are likely to pay rent on time, take care of the property, and adhere to lease agreements. By screening applicants thoroughly, landlords can minimize risks associated with property damage, lease violations, and late payments.

The various types of screenings involved include checking rental history, employment verification, criminal background checks, and references from previous landlords. These comprehensive checks provide a holistic view of the applicant’s past behavior and financial stability, allowing landlords to make informed decisions.

Conducting meticulous tenant screening is essential for landlords to maintain a safe, well-maintained rental property and establish positive landlord-tenant relationships based on trust and accountability.

Why is Tenant Screening Important for Landlords?

Tenant screening is crucial for landlords as it helps them make informed decisions based on background checks, credit assessments, and rental history verifications to select reliable tenants.

By conducting comprehensive tenant screening, landlords can significantly lower the risks associated with rental properties, such as late payments, property damage, or eviction situations. Through this process, landlords can identify potential red flags early on, ensuring a smoother and more secure tenancy experience. A thorough screening process can also lead to better communication and trust between landlords and tenants, fostering a positive landlord-tenant relationship. Prioritizing screening measures can greatly improve overall property management efficiency and reduce the likelihood of problematic tenancies.

What are Move-in Fees?

Move-in fees refer to the upfront charges that tenants pay before occupying a rental property, which may include fees for background checks, tenant screening reports, and other related services.

Definition of Move-in Fees

Move-in fees encompass the charges that tenants pay at the beginning of their lease term, often covering expenses such as rental property background checks and tenant screening services.

These fees can include a variety of costs, such as security deposits to protect the landlord in case of damages, first and last month’s rent to secure the property, and sometimes a non-refundable administrative fee to cover the paperwork involved in setting up the lease.

Understanding the breakdown of move-in fees is crucial for tenants to budget effectively and avoid any surprises. Landlords use these fees to ensure they are financially protected and to cover any initial expenses related to preparing the rental unit for occupancy.

What is the Purpose of Move-in Fees?

The primary purpose of move-in fees is to cover the costs associated with background checks, rental history verification’s, and tenant credit assessments to ensure the suitability of tenants for a rental property.

By requiring these fees, landlords can carefully screen potential tenants, which is a crucial step in the tenant selection process. The move-in fees provide a financial buffer for landlords, offering protection against possible damages or unpaid rent. This contributes significantly to risk mitigation, as it helps ensure that tenants are financially responsible and capable of maintaining the property. These fees also play a vital role in maintaining property standards, as they help cover initial cleaning and preparation costs before a new tenant occupies the rental unit.

What is a Security Deposit?

A security deposit is a refundable amount that tenants provide to landlords as a form of financial protection against potential damages, unpaid rent, or lease violations during their tenancy.

Definition of Security Deposit

A security deposit is a monetary sum paid by tenants to landlords before moving in, serving as a security measure against property damage, unpaid rent, or lease breaches.

It acts as a form of protection for landlords in case tenants cause damage to the property or fail to fulfill their rental obligations.

Security deposits are typically held in a separate account to ensure that they are available for return to the tenant when they move out.

Landlords must abide by state laws regarding the handling of security deposits, including the requirements for timely return and itemized deductions for any damages or outstanding rent.

What is the Purpose of a Security Deposit?

The primary purpose of a security deposit is to safeguard landlords from financial losses due to property damage, unpaid rent, or lease violations by tenants during their occupancy.

Security deposits play a crucial role in establishing trust and accountability between landlords and tenants. By requiring a security deposit, landlords can provide a layer of protection against unforeseen circumstances that may arise during a tenancy.

Furthermore, security deposits incentivize tenants to maintain the property in good condition and adhere to the lease terms.

From a legal standpoint, landlords are obligated to handle security deposits responsibly. This includes documenting the condition of the property before and after a tenancy, returning the deposit within the specified time frame, and providing a detailed account of any deductions made.

Comparison between Move-in Fees and Security Deposit

Move-in fees and security deposits are both forms of upfront payments in rental agreements, but they serve distinct purposes in covering initial costs versus providing financial security for landlords.

Similarities between Move-in Fees and Security Deposit

Move-in fees and security deposits share similarities as upfront payments are required from tenants before lease commencement, aiming to secure financial commitments and ensure responsible tenancy.

While move-in fees are non-refundable fees paid to cover administrative costs associated with preparing the rental unit for occupancy, security deposits serve as a protective measure for landlords against potential property damage or unpaid rent.

Both move-in fees and security deposits play crucial roles in property management by providing landlords with a financial cushion to address unexpected expenses or breaches of the lease agreement.

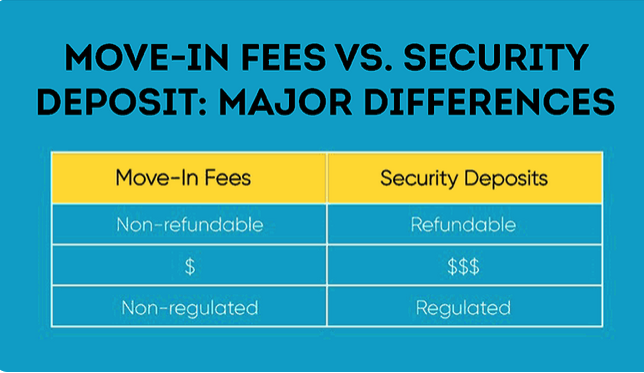

Differences between Move-in Fees and Security Deposit

The key differences between move-in fees and security deposits lie in their purposes: move-in fees cover initial expenses, while security deposits serve as financial guarantees against property damage and breaches.

Move-in fees are typically non-refundable and are meant to cover costs such as cleaning, application processing, and other administrative expenses. On the other hand, security deposits are held by the landlord during the lease term and are refundable provided the tenant abides by the terms of the rental agreement.

These payments play a crucial role in the landlord-tenant relationship. While move-in fees help landlords offset immediate costs, security deposits provide a sense of security for property owners and encourage tenants to maintain the property in good condition. Understanding the nuances of these financial aspects can lead to smoother tenancy agreements and better communication between both parties.

Which One Should Landlords Choose?

Landlords should carefully consider whether to opt for move-in fees or security deposits based on factors such as financial risk tolerance, tenant screening requirements, and legal compliance.

Factors to Consider in Choosing Between Move-in Fees and Security Deposit

Landlords should evaluate various factors when deciding between move-in fees and security deposits, including financial implications, tenant screening needs, and legal requirements to ensure compliance.

Financial implications play a significant role in this decision-making process. While move-in fees provide immediate funds, security deposits offer long-term security against potential damages or unpaid rent.

- Tenant screening needs vary based on the choice – move-in fees may attract different demographics than security deposits.

- Legal requirements, such as limits on deposit amounts or refund timelines, must be carefully considered to avoid disputes.

Landlords need to weigh these factors carefully before determining the best approach for their rental operations.

Pros and Cons of Move-in Fees

Move-in fees offer landlords immediate revenue and cover upfront costs, but they may deter potential tenants and require transparent disclosure to avoid disputes or misunderstandings.

On one hand, move-in fees can act as a financial buffer for landlords, offsetting any initial expenses involved in preparing a rental property for a new tenant. This can be particularly beneficial in maintaining a steady cash flow, ensuring that landlords can promptly address any maintenance needs or unexpected repairs.

However, it’s essential to note that these fees might turn away prospective tenants who are already burdened with the costs associated with moving. Landlords need to strike a delicate balance between safeguarding their investment and attracting reliable tenants who can afford additional upfront payments.

Pros and Cons of Security Deposit

Security deposits offer landlords financial security and protection against property damage, but they require compliance with legal regulations, timely refund processing, and potential disputes over deductions.

One of the primary benefits of security deposits is the peace of mind they provide to landlords, knowing that there is a financial buffer in case of unforeseen circumstances. Security deposits also act as a deterrent against tenants causing damage to the property, as they have a stake in maintaining its condition.

Challenges arise when it comes to complying with specific legal requirements related to security deposits. Landlords must ensure they adhere to local laws regarding deposit amounts, timelines for refunding deposits, and proper documentation of deductions.

How Can SmartScreen Help with Tenant Screening?

SmartScreen provides comprehensive tenant screening services, including tenant background checks, credit assessments, and verification processes to assist landlords in selecting reliable and trustworthy tenants.

Overview of SmartScreen’s Tenant Screening Services

SmartScreen offers a range of tenant screening services, including detailed reports, comprehensive background checks, and reliable data to help landlords make informed decisions about prospective tenants.

One of the key features that differentiates SmartScreen’s screening reports is their real-time updating system, ensuring that landlords have access to the most current information about their potential tenants. These reports provide a deep dive into each applicant’s rental history, creditworthiness, criminal records, and more, presenting a clear snapshot of their suitability as tenants. With SmartScreen’s advanced technology, landlords can easily navigate through these reports, gaining valuable insights swiftly and efficiently.

Benefits of Using SmartScreen for Tenant Screening

Utilizing SmartScreen for tenant screening offers landlords access to reliable data, streamlined screening processes, and enhanced risk assessment tools to select tenants with confidence and efficiency.

By leveraging the comprehensive screening services provided by SmartScreen, landlords can significantly reduce the time spent on vetting potential tenants. The platform employs advanced algorithms to analyze data and flag any potential red flags, allowing landlords to make well-informed decisions swiftly.

The detailed reports generated by SmartScreen not only assist in identifying trustworthy tenants but also help landlords maintain safe and secure rental properties. This proactive approach not only minimizes risks but also fosters a positive landlord-tenant relationship built on transparency and trust.

Frequently Asked Questions

What are move-in fees and security deposits?

Move-in fees and security deposits are two different types of fees that a landlord may require from a tenant before they move into a rental property. Move-in fees are a one-time, non-refundable payment, while security deposits are refundable amounts held as collateral for any damages or unpaid rent.

What is the difference between move-in fees and security deposits?

The main difference between move-in fees and security deposits is that move-in fees are non-refundable, while security deposits are refundable. Move-in fees are typically used to cover administrative costs, whereas security deposits are meant to protect landlords from potential damages or unpaid rent.

Are move-in fees and security deposits legal?

Yes, both move-in fees and security deposits are legal and can be charged by landlords. However, there may be laws or regulations that limit the amount that can be charged for these fees, so it’s important to check local laws and regulations.

What can move-in fees and security deposits be used for?

Move-in fees can be used for administrative costs related to the rental process, such as application fees, credit check fees, or move-in inspection fees. Security deposits, on the other hand, can only be used for specific purposes, such as covering damages to the property or unpaid rent.

Can landlords charge both move-in fees and security deposits?

Yes, landlords are allowed to charge both move-in fees and security deposits, as they serve different purposes. However, it’s important to clearly outline these fees in the rental agreement and follow any laws or regulations regarding the amounts that can be charged.

Is one better than the other – move-in fees or security deposits?

There is no clear answer to this question as it depends on the specific situation and preferences of the landlord. Some may prefer the non-refundable nature of move-in fees, while others may feel more comfortable with the added protection of security deposits. It’s important for landlords to carefully consider their options and make an informed decision based on their needs.