Landlords Guide to Cosigners

Landlords Guide to Cosigners

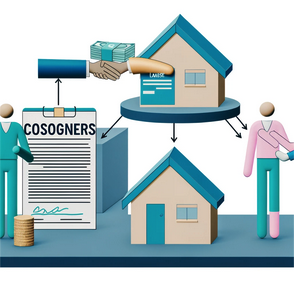

Are you a landlord looking to protect yourself and your property when renting to tenants? One key strategy is to require a cosigner. But what exactly is a cosigner, and why do landlords often require one?

In this guide, we will explore the role of a cosigner, who can be a cosigner, their responsibilities, and how to find one. We will also discuss the risks involved for both landlords and cosigners, as well as provide tips on how landlords can effectively use cosigners to protect their investments. Let’s learn everything you need to know about cosigners in the rental process.

What is a Cosigner?

A cosigner is an individual who agrees to take on the financial responsibilities of a rental agreement alongside the tenant. This guide explores the role of a cosigner in the renting process and their legal obligations.

By having a cosigner, landlords have an additional layer of security knowing that if the tenant fails to meet their financial obligations or breaches the lease terms, the cosigner is there to step in.

For tenants, having a cosigner can significantly improve their chances of getting approved for a rental property, especially if they have a limited credit history or a lower income.

Both the tenant and the cosigner should carefully review the lease agreement to understand their shared responsibilities, which may include paying rent, maintaining the property, and ensuring compliance with all terms outlined in the lease.

Why Do Landlords Require a Cosigner?

Landlords may require a cosigner to mitigate risks associated with tenant screening results, such as a negative credit check or rental history. The approval process often includes evaluating the financial stability of potential tenants and determining if a cosigner is necessary.

This additional layer of security serves as a safeguard for landlords in case the primary tenant cannot fulfill their rental obligations. By having a cosigner, landlords gain reassurance that there is a backup responsible party to cover any missed rent payments or damages to the property.

Cosigners are typically required to undergo similar screening procedures as the primary tenant, ensuring they meet the necessary credit and income requirements set by the landlord. Ultimately, the presence of a cosigner enhances the overall reliability and credibility of the tenant, contributing to a smoother and more secure rental process for all parties involved.

Who Can Be a Cosigner?

Individuals who can be a cosigners include family members, friends, or professional cosigners who are willing to take on the responsibilities and legal obligations outlined in the cosigner agreement. A cosigner acts as a guarantor for the tenant’s lease.

Having a cosigner can provide added assurance to landlords that the tenant will fulfill their lease obligations. Family members often step in as cosigners to help their loved ones secure a rental property. Friends may also offer their support by becoming cosigners, showing a strong belief in the tenant’s ability to meet rental requirements. Professional cosigners, such as companies specializing in this service, bring expertise in navigating the cosigner process and can offer a valuable resource to tenants facing challenges in meeting lease criteria.

What Are the Responsibilities of a Cosigner?

The responsibilities of a cosigner include guaranteeing the fulfillment of the terms and conditions outlined in the rental agreement, assuming liabilities if the tenant fails to meet their obligations, and entering into a contractual relationship with the landlord.

In essence, a cosigner is essentially vouching for the tenant’s ability to adhere to the lease terms and financial commitments. By signing the rental agreement as a cosigner, one becomes legally bound to make payments or remedy defaults if the primary tenant falls short. It’s crucial for cosigners to thoroughly comprehend the lease terms and conditions, as they are equally responsible for any violations or damages. This underscores the significance of careful consideration before agreeing to be a cosigner to avoid potential legal ramifications and financial risks.

How to Find a Cosigner?

Finding a cosigner can be done through various channels, including seeking support from family members or friends, engaging professional cosigners, or utilizing online services that facilitate the cosigning process. The approval criteria often involve providing personal information for evaluation.

For those considering using personal connections, reaching out to trusted individuals who are willing to vouch for financial responsibility can be a convenient option.

Professional services, such as cosigning agencies or financial institutions, offer a structured approach with experienced cosigners.

Online platforms provide a digital space to connect with potential cosigners who match specific requirements.

Once a cosigner is identified, the approval process typically involves submitting a rental application together, with detailed personal information for a thorough assessment by the landlord or leasing agency.

Family Member or Friend

Family members or friends can act as cosigners by signing a cosigner agreement, which outlines their responsibilities and liabilities in supporting the tenant’s lease. This personal connection often provides a sense of security for both parties.

Having a trusted individual like a family member or close friend as a cosigner not only serves as a safety net for the landlord but also offers peace of mind for the tenant. The familiarity and bond shared between the cosigner and the tenant lay a strong foundation for clear communication and understanding. It facilitates smoother resolution of any potential issues that may arise during the tenancy period. This solidarity leads to a more harmonious living arrangement and promotes a cooperative environment where all parties feel respected and supported.

Professional Cosigner

Professional cosigners offer their services to individuals seeking cosigners for rental agreements, assisting in the screening process, and conducting background checks to assess the financial stability of tenants. Their expertise streamlines the cosigning process.

By leveraging their knowledge and experience, cosigners can effectively evaluate the financial information provided by tenants, helping landlords make informed decisions. Professional cosigners play a crucial role in mitigating risks for landlords by providing a layer of security in case the tenant fails to meet their obligations.

For tenants, engaging a professional cosigner can increase their chances of getting approved for a rental property, especially if they have limited credit history or financial resources. The involvement of professional cosigners benefits both parties by facilitating smoother transactions and enhancing trust in the rental process.

Online Services

Online services cater to individuals seeking cosigners by facilitating the rental application process, enabling digital lease signing, and fostering seamless communication between tenants, cosigners, and landlords. These platforms enhance the cosigner search and agreement process.

They offer a convenient way for tenants to find suitable cosigners swiftly, eliminating the traditional complexities involved in securing a guarantor. By automating the verification and approval procedures, online services streamline the entire application journey, saving time for all parties involved. The digital lease signing feature simplifies the legal aspects, allowing tenants and cosigners to sign documents online from anywhere, reducing paperwork hassles and ensuring a quick turnaround. Effective communication channels provided by these platforms create transparency and trust among all stakeholders, promoting a harmonious rental experience.

What Information Should Be Included in the Cosigner Agreement?

The cosigner agreement should include the names and contact information of both the cosigner and the tenant, outline the lease terms, and rent payment details, and specify the responsibilities and liabilities of the cosigner. This document formalizes the cosigner’s commitment.

By clearly defining these key elements in the agreement, both parties are safeguarded in case of any lease-related issues. The agreement helps set expectations regarding the cosigner’s involvement throughout the tenancy, making it crucial to address any potential disagreements or misunderstandings upfront. Having a well-drafted cosigner agreement serves as legal protection for all involved, ensuring that everyone understands their obligations and rights in the rental arrangement.

Names and Contact Information

The cosigner agreement should accurately capture the names and contact information of the cosigner and the tenant, along with details of the rental property and the lease duration. This information ensures clear communication and accountability.

Having accurate names and contact details in a cosigner agreement is crucial for establishing a solid foundation of trustand responsibility between all parties involved. By clearly identifying the individuals entering into the agreement and specifying the property that is being leased, any potential misunderstandings or disputes can be minimized. Including this vital information not only facilitates effective communication but also plays a key role in ensuring that all terms and conditions of the lease are properly documented and understood by everyone involved.

Lease Terms and Rent Payment Details

The cosigner agreement should outline the specific lease terms, including rent payment details, due dates, and any additional financial obligations. Clarity on these aspects helps the cosigner understand their responsibilities in supporting the tenant.

The cosigner must be aware of the exact terms of the lease to prevent any misunderstandings or disputes down the line. By clearly defining when rent is due, how much is owed, and any penalties for late payments, the cosigner can actively assist in ensuring that the tenant meets their financial commitments on time. This level of transparency also encourages open communication between the tenant, landlord, and cosigner, fostering a cooperative environment that promotes financial responsibility and accountability.

Responsibilities and Liabilities of the Cosigner

The cosigner agreement must detail the responsibilities and liabilities of the cosigner, including potential financial obligations if the tenant defaults on rent payments or breaches the lease terms. Clarity on these aspects is crucial for legal protection.

Clearly defining these responsibilities and liabilities not only protects the cosigner but also ensures that all parties involved understand their roles and obligations.

In rental scenarios, the extent of liability for cosigners can vary based on the terms of the agreement. Cosigners need to comprehend the potential financial risks they are assuming by signing the agreement. Failure to fulfill the obligations as a cosigner can lead to legal consequences, impacting credit scores and financial stability. Therefore, a comprehensive understanding of these responsibilities is vital before agreeing to cosign a rental agreement.

What Are the Risks of Being a Cosigner?

Being a cosigner carries risks such as assuming financial obligations if the tenant defaults on rent payments, potential damage to the cosigner’s credit score, and legal consequences in case of lease violations. Understanding these risks is crucial for cosigners.

It’s important for individuals considering cosigning agreements to be aware that in the event the primary renter fails to make payments, the cosigner becomes responsible for fulfilling the financial obligations. This can lead to severe financial consequences and strain on the cosigner’s own budget.

If the tenant defaults or breaches the lease terms, the cosigner can be dragged into legal disputes, facing potential lawsuits or even having to cover the costs themselves.

Taking precautionary measures to fully grasp these risks is paramount before diving into any cosigning arrangement.

Financial Obligations

One of the primary risks of being a cosigner is the potential financial obligations that may arise if the tenant fails to fulfill their rent payment responsibilities. Cosigners should consider their financial stability before agreeing to cosign a lease.

It is crucial for cosigners to thoroughly assess their own financial capacity and understand the approval criteria set by the landlord or property management company. By doing so, cosigners can ensure that they are not taking on more financial risk than they can comfortably handle.

Cosigners can protect their financial interests by setting up clear communication channels with the tenant, regularly monitoring rent payments, and staying informed about the state of the lease agreement. In case of any uncertainties or issues, cosigners should not hesitate to seek legal advice or consult with financial experts to safeguard their financial well-being.

Damaged Credit Score

Cosigning a lease poses the risk of potential damage to the cosigner’s credit score if the tenant defaults on rent payments or lease obligations. Maintaining financial stability and monitoring credit reports are essential for cosigners.

This highlights the importance of cosigners being proactive in protecting their creditworthiness. By staying informed about the tenant’s payment behavior and ensuring open communication with them, cosigners can anticipate and address any issues early on. Cosigners must have a solid financial foundation themselves, as any missed payments by the tenant could reflect negatively on their credit report. Regularly reviewing credit reports, setting up alerts for any suspicious activity, and having a contingency plan in place can help cosigners mitigate the risks associated with cosigning agreements.

Legal Consequences

Cosigners may face legal consequences in case of lease violations or tenant breaches, potentially leading to legal disputes and financial liabilities. Understanding the legal implications of cosigning is crucial for protecting one’s interests.

In situations where the primary tenant fails to meet their obligations under the lease agreement, cosigners could find themselves dragged into legal proceedings, even if they were not directly involved in the violation.

To navigate these potential legal pitfalls, cosigners should proactively communicate with the primary tenant and the landlord to ensure everyone is on the same page regarding responsibilities and expectations.

Consulting with a legal professional before cosigning a lease can also provide valuable insights into potential risks and ways to protect oneself in case of tenant non-compliance.

How to Protect Yourself as a Landlord with a Cosigner?

Landlords can protect themselves when utilizing a cosigner by running thorough background and credit checks on both the tenant and the cosigner. Setting clear expectations, having a written cosigner agreement, and effective communication are key protective measures.

- By conducting comprehensive background checks, landlords can gain valuable insights into the financial responsibility and reliability of both the tenant and the cosigner.

- Establishing transparent expectations ensures that all parties are aware of their responsibilities, reducing the risk of misunderstandings.

- Documenting agreements in writing provides a clear reference point in case of disputes while maintaining open lines of communication fosters a positive and cooperative relationship between tenants, cosigners, and landlords.

Run a Background and Credit Check

Landlords should conduct thorough background and credit checks on potential tenants and cosigners to assess their risk profile and financial stability. This evaluation helps in making informed decisions and mitigating risks in the rental process.

By verifying a tenant’s background, including rental history, employment status, and criminal record, landlords can gain valuable insights into their reliability and trustworthiness. Credit checks offer a glimpse into the individual’s financial responsibility, highlighting any red flags such as outstanding debts or poor credit scores. Cosigners play a crucial role in rental agreements, providing additional security for landlords in case the primary tenant defaults on payments. Through these checks, landlords can protect their property and financial interests, ensuring a stable and profitable rental experience.

Set Clear Expectations

Establishing clear expectations with both the tenant and the cosigner regarding lease terms, rent payments, and responsibilities helps in avoiding misunderstandings and conflicts. Clarity in communication protects the interests of all parties involved.

Landlords must outline the specific terms of the lease agreement, including the duration, rent amount, due dates, and any potential penalties for late payments. By openly discussing these details with tenants and cosigners, everyone can have a shared understanding of their obligations and rights. Setting expectations upfront also aids in fostering mutual respect and cooperation throughout the tenancy. This proactive approach not only cultivates trust but also minimizes the chances of disagreements arising down the line.

Have a Cosigner Agreement in Writing

Documenting the cosigner agreement in writing is essential to formalize the responsibilities and obligations of the cosigner. A written agreement provides legal protection and clarity on the terms and conditions agreed upon by all parties.

By clearly outlining the roles and responsibilities of the cosigner in a written document, potential misunderstandings or disputes can be minimized. This agreement serves as a reference point for both the landlord and the cosigner, establishing a framework for the financial expectations and obligations. Having a legally binding cosigner agreement can offer a sense of security for all parties involved, ensuring that the terms of the rental arrangement are explicitly laid out and understood. This proactive approach can ultimately contribute to smoother rental processes and stronger relationships between landlords, tenants, and cosigners.

Communicate Effectively with the Cosigner

Maintaining effective communication with the cosigner throughout the rental process is crucial for enhancing transparency, addressing concerns, and making informed decisions. Open dialogue fosters a cooperative relationship and ensures mutual understanding.

Regular updates and clear communication channels not only help in clarifying responsibilities but also in establishing trust. Timely communication regarding any changes in the rental agreement or unforeseen circumstances can prevent misunderstandings and provide a sense of security for both parties.

Ongoing dialogue encourages cosigners to feel included in the decision-making process and allows landlords to address any queries promptly, fostering a sense of collaboration and respect in the relationship.